Commercial Insurance

Marine Cargo Insurance

Marine Cargo insurance protects all goods whilst in transit, depending on the needs of the client. Three broad types of cover are available, i.e. Institute Cargo Clauses “A”, “B” and “C”. The cover takes care of risks associated with different modes of transportation

Coverage may be provided for individual shipments or under an ongoing contract known as an “open policy”. An open policy is a contract prepared in general terms covering specified goods on terms agreed and can be issued to cover goods shipped anywhere in the world on a declaration basis.

Coverage may be provided for individual shipments or under an ongoing contract known as an “open policy”. An open policy is a contract prepared in general terms covering specified goods on terms agreed and can be issued to cover goods shipped anywhere in the world on a declaration basis.

Coverage can vary as under, based on the nature and type.

- All risks land

- All risks by sea or air or parcel post.

- Restricted cover by sea, air, parcel post or land.

The Sum Insured is the agreed value, which in most cases will be CIF and/or C&F plus 10% or FOB plus 10 to 20%. The factors are taken into account for calculating the premiums depend on the nature and type of cargo, method of packing, mode of shipment, age, and type of vessel and the ports to be used.

Our technical team will be happy to assist you should you require additional information or further clarification.

Marine Hull Insurance

We can offer tailor-made policies to protect against Marine hull and machinery risks from bow to stern – from single vessels to the largest fleets.

Involved in Marine hull and machinery insurance since inception, Noble is one of the strongest and most experienced Marine Broker in the UAE market.

Cover under this insurance

We provide Marine hull and machinery insurance for all types of ships and vessels and their equipment, including:

- Container ships

- Oil & gas tankers

- Bulk carriers

- Passenger vessels

- Fishing vessels

- Tugs and barges

- Towboats

- Offshore energy

- Support vessels

The Sum insured is the value of the hull, which is required to be ascertained and agreed upon by an independent and qualified Marine Surveyor. The factors to be considered to arrive at the premium are based on the following:

- Type of Hull.

- Tonnage.

- Fleet or singleton.

- Trade of the vessel.

- Ownership / management.

- Classification.

- Flag & registry.

- Valuation of the vessel.

- Past loss history.

- Insurance Conditions offered.

Marine Hull & Machinery insurance mainly covers:

- Total Loss &/or Constructive Total Loss,

- Machinery/Engine Damage

- Collision liability risk

- Loss mitigation expenses

- General average contributions

- Increased value in case of total loss

- War

Our technical team will be happy to assist you should you require additional information or further clarification.

Protection and Indemnity Insurance

P & I Insurance covers the ship owners against their liability. The requirement of every (port)/ ship is to have this cover prior to entering the ports for loading &/or discharging. It covers most of the risks, which are historically not written under Marine Hull Insurance.

In basic terms, Protection and Indemnity insurance, or “P&I” as it is usually called, is a ship owner’s insurance cover for legal liabilities to third parties. “Third parties are any person, apart from the ship-owner himself, who may have a legal or contractual claim against the ship. P&I insurance is usually arranged by entering the ship into a mutual insurance association, usually referred to as a club. Ship-owners are members of such clubs. Legal liability is decided in accordance with the laws of the country where an accident takes place.

The P&I insurance cover for contractual liability which is agreed at the time the owner requests insurance cover from the club and is usually in accordance with the owner’s responsibility under crew contracts or special terms relating to the trading pattern of the vessel.

EXPLANATION OF THE TERM, “PROTECTION AND INDEMNITY”

The word protection simply means that the insurance also covers assistance when a ship is involved in an accident and the ship-owner and his Master need help. Often the club’s early intervention and assistance will help to head off problems and serve to protect the ship-owner from inflated claims.

P&I insurance is an indemnity type of insurance, which means the ship-owner (or member of the club) must demonstrate his loss before the club will pay out (or indemnify him) under the terms of the insurance policy. It is important to bear in mind that the club never assumes the owner’s liability; therefore, technically the owner (or member) is always responsible for payments (the “pay to be paid” principle). In practice, the club takes over the business of handling claims and ensuring that payments are correctly made.

RUNNING DOWN CLAUSE (RDC) AND FIXED OR FLOATING OBJECTS (FFO)

The P&I cover may include liability for collisions (“RDC”), for example when the member’s ship is in a collision with another ship, or when the entered ship strikes a fixed object, i.e. a quay, dock or buoy (“FFO”). However, collision and striking liabilities are often included in the ship’s hull and machinery cover, for instance under the Norwegian Insurance Plan. Therefore, it is important for a Master to ascertain whether his vessel’s collision insurance (collision between ships) and striking insurance (i.e. when a ship strikes a fixed or floating object which is not another ship) is covered under his P&I policy or under his hull and machinery policy. To be safe, it is always wise for a Master to inform the P&I club, or the club correspondent, if his vessel is in a collision with another vessel or a fixed object.

DEATH AND PERSONAL INJURY ON BOARD THE VESSEL

P&I insurance covers an owner’s liability for all deaths, personal injuries and illnesses which occur on board, including death or injury to crew, passengers, stevedores, pilots and visitors to the ship.

REPATRIATION OF SICK OR INJURED CREW AND HOSPITAL EXPENSES

P&I insurance also covers a ship owner’s liability to pay for the costs of repatriating crew members who become sick or are injured on board. The insurance also covers the crew’s hospital bills and costs of sending replacement personnel to the ship if necessary.

LOSS OF CREW MEMBERS PERSONAL EFFECTS

P&I insurance also covers the owner’s liability for loss of crew belongings in cases of shipwreck or fire on board. The cover only applies to items which are deemed to be reasonable for any crew member to have with him on board. A crew member travelling with unusually expensive items, such as laptop computers, gold watches etc should make sure that he has such items separately insured.

LOSS OF OR DAMAGE TO CARGO

One of the major functions of Protection and Indemnity insurance is to cover a shipowner, or the charterer of a ship, for liability for loss of, or damage to, cargo if there has been a breach of the contract of carriage. This breach of contract usually means that something has happened to the cargo while it was on board the ship or being loaded or discharged, and for which the owner or charterer can be held responsible, i.e. shortage or damage to the cargo. Therefore, if a Bill of Lading is signed and states that 10,000 sacks of potatoes are loaded and only 9,500 are discharged – then the ship (the owner or charterer, or both) may be held liable for the loss. Usually, the cargo insurers will pay the person or company who owns the cargo (the receiver) for the costs of loss or damage to that cargo. The cargo underwriters will then seek to recover their losses from the shipowner or charterer. The P&I club will usually take over the handling of such claims on behalf of the assured. This is one of the reasons why evidence in the form of documentation, copies of the log book, surveys of damaged cargo, copies of tally books, dated photos of loading in the rain etc are very important in establishing the exact reason for the damage. There are certain defences open to the shipowner, such as being able to establish that the packaging of the cargo was not good enough to protect it during transportation.

OTHER P&I COVERED RISKS

Other risks covered include liability for stowaways, liability for oil pollution and other types of pollution and legal liability for wreck removal if the ship sinks and is blocking free navigation for other vessels. In short, P&I insurance is a very comprehensive type of insurance cover which makes it easier for a shipowner or charterer to trade in international shipping transportation. P&I is as important to a prudent shipowner as his Hull and Machinery insurance cover.

Our technical team will be happy to assist you should you require additional information or further clarification.

Aviation Insurance

Noble Insurance can arrange cover to smaller aircraft and helicopters including privately owned aircraft, commercial activities and fleets, clubs and flying schools, business jets and ground service providers against the loss or damage, legal liability to third party and to passengers arising out of the operation of the aircraft.

General Aviation Insurance

Hull and liability cover for smaller aircraft and helicopters including privately owned aircraft, commercial activities and fleets, clubs and flying schools, business jets and ground service providers.

Types of Aviation Insurance :

1. Aircraft Hull and Liability

There are several standard aircraft liability policies in the London market, but for the purposes of keeping it simple, we will focus primarily on AVN1C, which is the London Aircraft Insurance Policy. This policy is mainly used for general aviation business, as opposed to major airlines, which obviously require wider coverage than is provided by this standard form. It covers both the hull risks and the insured’s liability to third parties and passengers. There are four main sections to AVN1C:

- Section I: Loss of or damage to aircraft

- Section II: Legal liability to third parties (other than passengers)

- Section III: Legal liability to passengers

- Section IV: General exclusions applicable to all sections Conditions precedent applicable to all sections General conditions applicable to all sections Definitions

Section I – Loss of or damage to aircraft:

Insurers will pay for, replace or repair the accidental loss of or damage to the aircraft described in the schedule under the policy for the risks covered (generally being flight, taxiing and ground risks). It would be common for aircraft policies to have a separate premium rate for flight risks and a reduced premium rate for ground risks. Operators should be aware of such differentials when seeking insurance, particularly if they have a fleet of business jets, which may have long periods of grounding for commercial reasons or economic downturn. Operators may be able to negotiate the inclusion of a ‘lay-up’ clause (AVN26A) which would provide premium returns for aircraft ‘laid-up’ for a defined period of time, thus keeping insurance costs to a minimum, subject to various conditions being met, i.e. not for maintenance/overhaul or repair purposes and a minimum of 30 days lay-up.

The policy is underwritten on an ‘insured value’ basis whereby, although value is attributed to the aircraft at inception, the reduced (depreciated) value of the aircraft at the time of any loss is the value that would be used for claim settlement in the event of a total loss. This can, however, be amended to an ‘agreed value’ basis, thus the amount to be paid in the event of a total loss is set at inception under the schedule of aircraft. Any partial losses will be subject to the applicable deductible. Operators should seek insurance on the best terms available regarding lower deductibles. Insurers are flexible in providing alternative premium structures to accommodate various deductible options and the current market for business jets appears to be softening, insofar that very low deductibles can be achieved.

Turbojet aircraft are susceptible to foreign object damage despite recent improvements in design efforts. Operators should note that foreign object damage is only covered if it is attributable to a ‘single recorded incident’ (being recorded in the aircraft technical log). However, consequent damage sustained to other parts of the aircraft is covered.

Spares coverage is often included within Section I at an additional premium, rated against ‘values at risk’. Operators should ensure that their spares inventory is kept up to date and declared to their broker.

Section II – Legal Liability to third parties (other than passengers):

Insurers will indemnify the insured for all sums that the insured becomes legally liable to pay as damages (including costs) in respect of accidental bodily injury or property damage caused by the aircraft or by any person or object falling therefrom.

The policy excludes injury to employees, namely directors/employees acting in the course of their employment, operational crew (can be written back in), passengers (insured under Section III), property belonging to, or in the care, custody and control of the insured, noise and pollution as defined under aviation clause AVN46B.

Operators should consider the limit of indemnity being purchased and seek advice from their insurance broker to ensure that the limit provides adequate protection given their fleet size, aircraft type and area of operation. In Europe, the EU will also have to be adhered to with regards to minimum insurance liability limits for both passengers and third parties, which is determined by aircraft type, take-off weights and seating capacity.

Section III: Legal Liability to passengers:

Insurers will indemnify the insured for all sums the insured becomes legally liable to pay as damages (including costs) in respect of accidental bodily injury to passengers whilst entering, on board or alighting from the aircraft and for loss of or damage to baggage/personal effects arising out of an accident to the aircraft. Again, employees and operational crew are excluded. Operators may wish to consider purchasing an independent Personal Accident policy to cover pilots, crew and other passengers.

Operators again need to consider the limits of indemnity purchased for passenger liability. Most limits are purchased on a ‘combined’ basis in conjunction with Section II above. It would not be uncommon for insurers to impose ‘passenger caps’ on certain areas of operation to limit their liability on a ‘per passenger’ basis, so this should be considered and negotiated should the need arise, with particular reference to their lease/finance agreements, to ensure there are no coverage shortfalls. A ‘passenger cap’, for example, might be included if operators were regularly flying to the USA, given the litigious nature of this country, i.e. ‘passenger liability in respect of operations within the USA would be limited to US$500,000 each and every passenger’.

Section III would be subject to general exclusions such as ‘illegal uses’, those uses not stated in the policy at inception. Geographical limitations are also imposed where cover is excluded outside the areas stated in the policy. Operators should therefore be actively keeping their broker up to date with regards to the areas of operation, although it would not be uncommon for many business jet policies to have ‘worldwide’ coverage as standard. Nuclear risks and war, hijacking and other perils are also excluded by virtue of standard market clauses.

2. War, Hijacking and Other Perils Exclusion Clause (Aviation) – AVN48B

It is standard for AVN48B to be included within the wording of a policy. This clause ‘expands’ the exclusion beyond those pure ‘war’ perils and operators should pay close attention to what perils are excluded. In essence, the clause excludes above and beyond the basic ‘war, invasion and acts of foreign enemies’ and goes further to exclude (inter alia) any hostile detonation of a weapon, strikes, riots, civil commotions, malicious acts or acts of sabotage, confiscation, nationalisation, seizure by any government or local authority and hijacking without the consent of the insured.

It is common practice for operators to ‘buy-back’ the majority of these exclusions in respect of both hull and liability coverage. Operators can purchase a liability ‘writeback’ which provides liability coverage for the majority of the excluded perils contained in AVN48B. This clause is known as AVN52 and is regularly amended and updated. The majority of insurers now offer this coverage up to the ‘Combined Single Liability Limit’ within their policy and operators should ensure that such coverage is in line with their lease/finance agreements in order to avoid any shortfalls. If, on occasions the incumbent insurer is unable to offer AVN52 coverage up to the limit of liability, then it can be purchased as an excess layer independently through alternative insurers with such capacity.

Hull war can also be purchased independently, known as LSW555D (also regularly updated and revised). The coverage provided mirrors that excluded by AVN48B in respect of hull coverage, with one exception, namely in essence, nuclear detonation. War policies often pay up to 90 per cent of extortion, confiscation and hijack expenses. Operators should note that ‘confiscation by the Government of Registry’ of the aircraft is excluded, although this could be added back into the policy at an additional premium. Repossession by any title holder is also excluded, alongside the market wide ‘five major powers’ exclusion, which is mandatory.

Our technical team will be happy to assist you should you require additional information or further clarification.

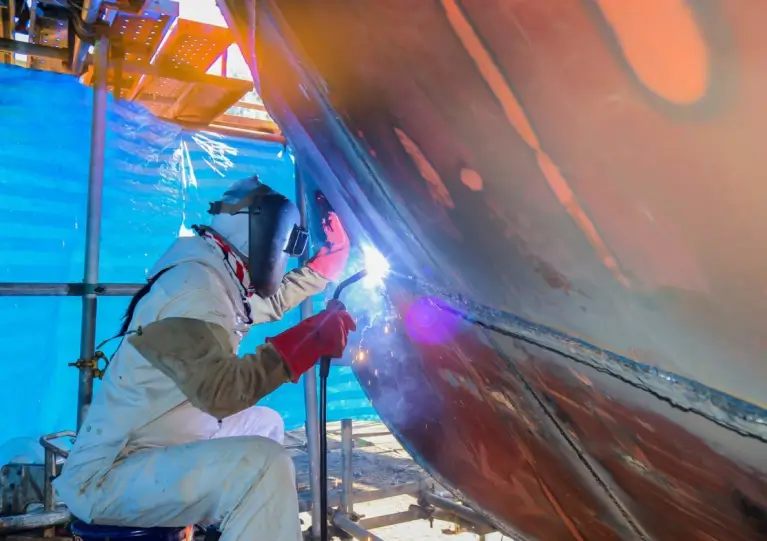

Ship Repairers Liability Insurance

Noble Insurance is able to arrange, place and manage all your Ship Repairers Insurance requirements.

As a ship repairer you may become legally liable for craft in your care, for third party property damage and for loss of life or personal injury. This insurance provides for your protection against such liability including liability for third party costs and expenses up to the limit agreed, caused by your negligence or the negligence of your servants, agents or subcontractors.

In addition, Ship Repairers Insurance cover will cover your legal defense costs.

Underwriters typically offer two types of insurance cover – Ship repairers’ Liability Standard Clauses designed to suit the smaller possibly part- time operator and Ship repairers’ Extended Liability Clauses for large ship yards and/o ship repairers with an extensive range of ship repair activities.

The Ship Repairers Insurance policies offer affordable insurance cover for smaller or part-time ship repairers of potential liability for damage to vessels being worked upon, and for third party property damage, death or injury.

Special extended Ship Repairers Insurance cover is available for larger ship yards or boat yards, potentially eliminating the need for certain public liability insurances.

Ship Repairers Insurance cover typically includes liability for:

- Loss of or damage to any vessel or craft in your care, custody or control

- Removal of wreck

- Third party property/death or personal injury

- Travelling workmen – limit subject to Extended liability clauses only

- Car park

- Loss of hire, loss of use

- Tenant’s liability

- Travelling workmen (world-wide)

- “Hot work” on vessels not previously engaged in carrying hazardous cargoes where such liability occurs in the course of or arises from your ship repairing operations.

Optional Extensions of Ship Repairers Insurance Cover includes:

- Other works outside of ship repairer’s operations.

- Storage of watercraft

- Warranty / maintenance guarantee obligation

- Worldwide service for ship repair work.

Our technical team will be happy to assist you should you require additional information or further clarification.